Past Entry of Zippy's Telecom Blog

More Previous Columns

October 19, 2009

Extreme Networks’ New BlackDiamond 20804 Ethernet Transport Switch — A talk with Mark Showalter, Director of Service Provider Marketing, Extreme Networks, and Peter Lunk, Senior Director of Service Provider Marketing, Extreme Networks

On October 13, 2009, Extreme Networks, Inc. (Nasdaq: EXTR), announced the BlackDiamond® 20804 Ethernet Transport switch, their latest addition to the BlackDiamond 20800 Series of high-performance, carrier Ethernet switches. The 20804 is specifically engineered to handle the increasing bandwidth demands of residential video, business Ethernet and mobile backhaul services.

For Tier 2 and Tier 3 carriers migrating from SONET/SDH and 1 Gigabit per Second (Gbps) Ethernet rings to 10 Gigabit Ethernet rings, the BlackDiamond 20804 provides an impressive 120 Gbps per slot line-rate switching capacity in a 4-slot chassis, supporting up to 32 line-rate 10 GE ports per chassis today, with ample bandwidth for future 100 Gigabit Ethernet I/O Modules, and is designed for future switch fabric upgrades to enable 480 Gbps of switching capacity per slot.

Video services are increasingly seen as a “killer” app in terms of driving increasing traffic demands and as a source of service provider revenue growth. According to Michael Howard at Infonetics Research, “Our recent residential services report shows that by 2011, the service provider revenue for video services will surpass voice services, but will be marked by high programming costs and tight margins. Specifically designed for the move from SONET/SDH to next-generation Ethernet transport, Extreme's BlackDiamond 20804--with its multicast quality of service, 10GE ports, and service management tools--is especially suited to small and medium size operators providing video services.”

Moreover, to simplify network operations, reduce technician training time, and reduce cost of network spares, members of the BlackDiamond 20800 Series use the same power supplies, IO modules and management modules.

Recently Yours Truly had an extensive conversation about the BlackDiamond 20804 (and the 20800 series in general) with Extreme Networks’ Director of Service Provider Marketing, Mark Showalter, and Extreme’s Senior Director of Service Provider Marketing, Peter Lunk.

MS = Mark Showalter

PL = Peter Lunk

RG = Richard Grigonis

RG: Tell me about the BlackDiamond 20804.

MS: The BlackDiamond 20804, our new switch in the BlackDiamond Series, allows carriers to “change the game” with next-generation transport. The BlackDiamond 20804 is our fifth-generation Ethernet transport switch. Consider for a moment the benefits for carriers that it provides:

First, it allows for graceful service expansion, so it increases network longevity. The equipment that you install you don’t have to replace every time new technology or a new data rate appears.

Second is support pro-active service management, which should please a carrier’s subscribers. Carriers are in fact shifting from reactive circuit management to pro-active service management. “Delighting subscribers” is one way they can differentiate themselves in the marketplace.

Third is lowering the cost of ownership of these next-generation networks. We see the demand for bandwidth outpace the revenues available for some of these services. It’s important that carriers are building a easy-to-operate, low-cost, next-generation network that allows them to scale these services.

So the BlackDiamond 20804, our new fifth-generation transport switch, is part of our 28000 Series. In 2008 we announced the 20808, which is the larger 8-slot version. The BlackDiamond 20804 is the 4-slot version of the switch.

RG: So there's both a commonality of components and a "pedigree."

MS: Extreme Networks has been in this business for a long time. Our first product was an Ethernet switch and that’s all we’ve been building since then. We have been a public company for over 10 years and we’ve shipped over 20 million Ethernet ports around the world. They do business in 50 countries worldwide, which is one of the reasons we have a 24x7 global TAC [Technical Assistance Center] with a presence in the US, a level one call center in Raleigh, a presence in Santa Clara, and we have a presence in Japan and Utrecht in Europe. So we have global technical assistance and this involves supporting customers all around the world.

MS: Extreme Networks has been in this business for a long time. Our first product was an Ethernet switch and that’s all we’ve been building since then. We have been a public company for over 10 years and we’ve shipped over 20 million Ethernet ports around the world. They do business in 50 countries worldwide, which is one of the reasons we have a 24x7 global TAC [Technical Assistance Center] with a presence in the US, a level one call center in Raleigh, a presence in Santa Clara, and we have a presence in Japan and Utrecht in Europe. So we have global technical assistance and this involves supporting customers all around the world.

Our revenues on average are a little under $400 million a year. Thirty percent of that is from carriers. Our company is debt-free. There is no long-term debt. We’re cash flow positive. We have $100 million in the bank. We enjoy the fact that, as the economy has gone sideways, we’ve been able to grow marketshare and be stable. Over 200 patents have been issued and/or pending worldwide, all of it concerning Ethernet technologies and deploying Ethernet. Finally, 18 percent of our revenue is reinvested in R&D. That’s a relatively large number in this industry. In the last few years, more than half of that has been in the carrier space, and you’ll see that investment being paid out in our latest announcement and others in our carrier product line.

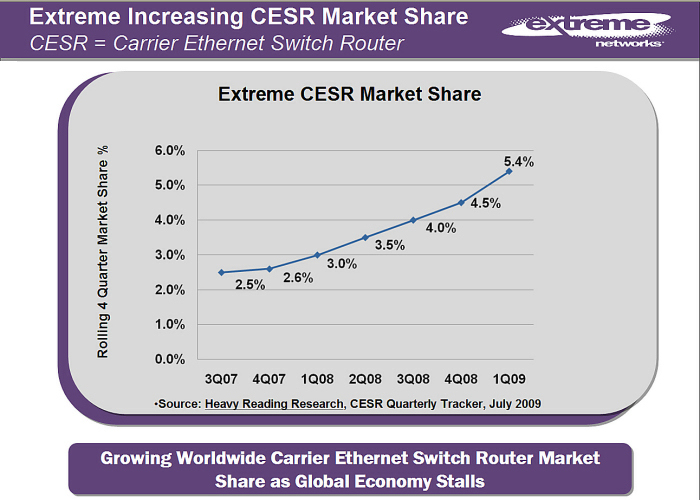

You’re probably familiar with Stan Hubbard and the folks over at Heavy Reading Research. Stan has a quarterly tracker, the Carrier Ethernet Switch and Router [CESR] market share. This is my personal favorite chart from the report [See illustration at right].

The report shows how, over time, our marketshare has been rising in the Carrier Ethernet switch and router marketplace. In the first quarter of 2009 we saw a jump up to 5.4 percent, even though there was an overall market decline—Cisco, for example, lost quite a bit of market share.

People often ask what the reasons are for our continued growth in the market. We typically see two reasons.

One reason is that the tightening economy has really driven carriers to shop around more, to be more considerate of their spending and to be more prudent. Whenever they shop around, that helps us, because that gives us an opportunity. People tend to be considering the premium they have to pay for Cisco switches and so they are interested in alternatives.

The second reason for our growth is our new product line. We introduced the BlackDiamond 20808 last year and started shipping it in the first quarter. We also introduced the Summit X650, which is a 1RU 24x10 Gigabit Ethernet switch. So we’ve been introducing new products, we’ve been increasing our focus, and this has paid off in terms of increased market share, even as the economy stalls.

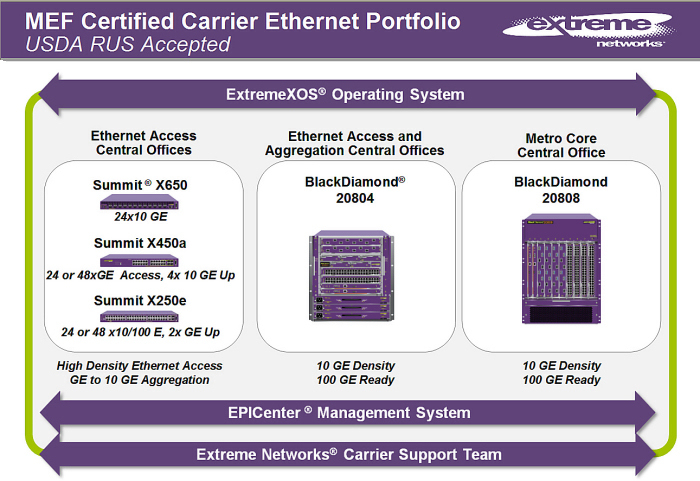

MS: Look at the breadth of our Extreme Networks product line and where the 20804 fits in the family. The illustration [at right] shows only our carrier products. As you probably know, Extreme Networks also sells switching lines into the enterprise and data center. But this summarizes our MEF [Metro Ethernet Forum] Certified Carrier Ethernet Portfolio. The Summit products, our 1RU [1.75-inch high] models on the left, typically used for aggregation of Ethernet access and connection to a 10 gig backhaul. On the right, the BlackDiamond 20808, for metro core central offices, has high line-rate 10 gig density. There are 64 line rate 10 gig ports in that switch, and it 100 Gigabit Ethernet ready. Between these two is the BlackDiamond 20804. It allows carriers to start with a platform size that only needs 4 slots and up to 32 slots 10 Gig Ethernet ports, and be able to grow the system, such as the BlackDiamond 20808, using common hardware and common software to slower the cost of ownership, and lower the investment in training and lower the cost of spares.

MS: Look at the breadth of our Extreme Networks product line and where the 20804 fits in the family. The illustration [at right] shows only our carrier products. As you probably know, Extreme Networks also sells switching lines into the enterprise and data center. But this summarizes our MEF [Metro Ethernet Forum] Certified Carrier Ethernet Portfolio. The Summit products, our 1RU [1.75-inch high] models on the left, typically used for aggregation of Ethernet access and connection to a 10 gig backhaul. On the right, the BlackDiamond 20808, for metro core central offices, has high line-rate 10 gig density. There are 64 line rate 10 gig ports in that switch, and it 100 Gigabit Ethernet ready. Between these two is the BlackDiamond 20804. It allows carriers to start with a platform size that only needs 4 slots and up to 32 slots 10 Gig Ethernet ports, and be able to grow the system, such as the BlackDiamond 20808, using common hardware and common software to slower the cost of ownership, and lower the investment in training and lower the cost of spares.

Moreover, the BlackDiamond 20808, the BlackDiamond 20804 and the Summit Series all use the ExtremeXOS operating system. This is a common operating system that lowers the operational cost for the carrier. All of these models are also managed by EPICenter, our system for provisioning and management of services across these switches. And of course, all of these are supported by the Extreme Networks Carrier Support Team.

PL: Extreme has over 100 carrier customers around the world. Let me mention three of them that are deploying the Extreme Networks BlackDiamond 20808 switch that we launched in 2008. First is VTC [Vernon Telephone Cooperative] which is an independent operating company situated in Wisconsion that is using the 20808 on a ring around their service area, to provide IPTV and high definition video services to their subscribers.

Meanwhile, in Hamburg, Germany, wilhelm.tel is also using the BlackDiamond 20808 to roll out IPTV across services in Hamburg.

And in Croatia we’re seeing IPTV deployment by Hrvatski Telekom.

So, all of our customers that are carriers can be found all over the world, and these are just three examples of who is using our high-end BlackDiamond 20808.

RG: I would presume the reason the BlackDiamond 20804 will be so valuable to carriers is that its flexible capabilities mirror the trends in carrier networks.

MS: Carriers pursue different kinds of revenue opportunities, and the 20804 can change the game for them. I’m sure you’ve seen the trend in carriers where, their losing revenue because they are not selling voice anymore, and they’re losing revenue from a decline in the use of T-1s, and they’re trying to replace those revenues with IPTV and other video services.

Infonetics Research published their report, “IPTV and Switched Digital Video Equipment, Services, and Subscribers Market Share and Forecasts,” in July 2009. It shows the growth in worldwide IPTV revenue, from $7.2 billion in 2008 to $55.9 billion in 2013. That’s interesting because, once again, in the face of a declining economy, we’re seeing a pretty strong growth curve for services. This is the revenue that carriers are pursuing and it’s driving them to do next-generation equipment deployments.

RG: What about the actual trends in subscriber services?

MS: First of all, we see three different types of subscribers: Residential, Business and Mobile Backhaul. And we’re seeing trends that pretty mush align in all of these different areas.

In the case of the Residential subscriber, we’ve observed a shift from voice and DSL access to the Internet, to a triple-play offering, where the carrier is offering voice, video and high-speed Internet over Active Ethernet or PONs [Passive Optical Networks] to the house/home/residence.

We’re also seeing a shift in Business services from separate voice and data networks to one converged network where voice, Ethernet and VPN [Virtual Private Network] access is all available over Ethernet.

In the Mobile Backhaul space we’re also seeing a shift from TDM [Time-Division Multiplexing] to Ethernet access for mobile backhaul that must now increasingly carry voice, video and Internet Access for mobile users.

All-in-all, we’re seeing continued demand for services that are associated with higher bandwidth and higher performance, and multiple services are converging onto a common network. These trends in residential services are driving changes in carrier networks.

The demand for high-bandwidth services on both the business and residential side are also driving several changes in the aggregation network that connect those subscribers to the core where IP services ‘live.’ The main change here, of course, is the change from circuit to packet technology. For some time now we’ve observed that SONET and SDH networks have been growing, but in the last year they’ve been capped. We’ve seen a peak in the growth of SONET and we’re seeing new investments in Ethernet and optical systems. So the overall shift is from circuit SONET and SDH to 10 Gigabit and eventually 100 Gigabit Ethernet transport rings in the access and aggregation areas.

Related to this shift from SONET to Ethernet transport rings is a shift from Automatic Protection Switching, or APS, to Ethernet APS, or EAPS, and then eventually to G.8032 resilient Ethernet ring technology. G.8032 is a new protocol that the ITU [International Telecommunications Union] is working on. I’ll talk about that a bit later. It’s a ring resiliency protocol that essentially helps enable fault tolerance for services across Ethernet rings.

A final trend in carrier aggregation networks is the shift from re-active circuit management to pro-active service management. In the old days, a carrier would look at a link and the link would fail, then they’d work on the link, but they’d be waiting for the customer to call them about the line being down. Today, as the market is more competitive, carriers want to be able to monitor services—and multiple services on a link—and be able to let the customer know immediately that a link has failed. So, that’s a shift from re-active to pro-active and from circuit management to service management. One of the reasons this is so important is because as the customer has services on a single line, they get more touchy about the possibility of that one line going down. It’s one thing if just your voice line is down and your data network is still up, but when one line is transporting everything, then it’s much more critical that you’re able to provide pro-active service.

Therefore, having more services on shared network increases both subscriber sensitivity and the importance of service management.

The Video Perspective

MS: I want to talk now about why some of the features available in the BlackDiamond 20800 Series and the 20804 specifically matter to carriers that are rolling out video services. I’m just using video as an example. The platform is designed for converged networks, which includes video for residences, business Ethernet and mobile backhaul applications. But let’s focus on video applications for a moment and why some of the features of the BlackDiamond 20804 matter.

First of all, we can achieve 480 Gigabits per second [Gbps] per slot. Why does such capability matter for video deployments? There’s also a related point: Why does the BlackDiamond, which can do 120 Gbps per slot, matters for a carrier? Revenue opportunity drives network investment. High-bandwidth services demand high-performance networks, so revenue growth and service quality depend on bandwidth availability. Imagine a residential subscriber who has Ethernet Fiber to the Home [E-FTTH]. The subscriber connects via fiber to a Ethernet Access Central Office [CO]. This access aggregation CO uses a BlackDiamond 20804 that today serves multiple 10 Gbps Ethernet rings today. Because the 120 Gbps per slot of the BlackDiamond 20804 gives us a line rate 10 Gbps density today, the carrier can build high performance 10 Gbps rings across the network, across their geography. Then, when the carrier needs to upgrade to a 100 Gbps bandwidth, the line rate capability of 120 Gbps per slot will allow the BlackDiamond 20804 to accommodate line rate 100 Gbps Ethernet, thus allowing the carrier to reuse their investment as the network grows over time.

For carriers to take advantage of the kind of revenue opportunity we discussed earlier concerning IPTV, they are going to need to roll out a lot of bandwidth. The ability to scale, from 10 Gbps to 100 Gbps without a forklift upgrade, is pretty important.

RG: Getting back to this concept of pro-active service management, can this work with any service?

MS: One of the capabilities of the BlackDiamond 20804 is hardware support for multicast Quality of Service [QoS]. Why does this matter? If a carrier is attempting to push a differentiated offering to multiple types of subscribers, such as “value subscribers” and “premium subscribers,” to get the most market share penetration they need to be able offer an array of services at different prices. With multicast QoS a carrier is able to differentiate different video services from premium video and live sports, down to best-effort video. With multicast QoS you can ensure that the services for which the subscribers are paying the most will always get through no matter what the network performance is.

Live sports drives a lot of multicast video traffic. Carriers have found that live sports, often in rural areas, are popular and are being covered by local people who take cameras and shoot the local high school football and soccer games, and subscribers are seeing great coverage on the local network. That allows the local telephone companies to compete with the big guys such as Comcast, which may have come into their neighborhood. With differentiated services, carriers are able to address different subscriber markets, thus enabling the carriers to increase overall service penetration rates.

With pro-active service management, Ethernet OAM&P [Operations, Administration, Maintenance and Provisioning] also matters. As you know, in the SONET era, there were various tools developed by Bellcore for provisioning, testing and maintaining networks. Now, without Bellcore driving it, we see other standards bodies driving these efforts around the world. One of these standards bodies is the ITU, which has a protocol called Y.1731 for packet jitter and latency measurement. Another standards body, the IEEE, also has a protocol called 802.1AG, for Continuity Fault Management [CFM]. Why does this matter? Continuity fault management enables a carrier to monitor individual service paths across the network for different services. Because the BlackDiamond 20804 has hardware support for CFM, it allows us to scale the support of CFM and provide proactive service management for subscribers across the network. This standards-based operation enables a carrier to learn a system they can use across a multi-vendor network and manage multi-vendor, multi-provider networks, because these protocols can also be used to manage across different islands of service providers.

Together, these protocols are managed by our EPICcenter Management System to provide end-to-end visibility for the carrier, and they allow it to provide pro-active service management for the subscribers. Furthermore, the service management system in general simplifies operations, since we have easy-to-use tools for provisioning and monitoring Ethernet transport networks.

RG: And of course there is flexibility in terms of being able to provide a graceful service expansion, even when dealing with something as bandwidth-hungry as video, correct?

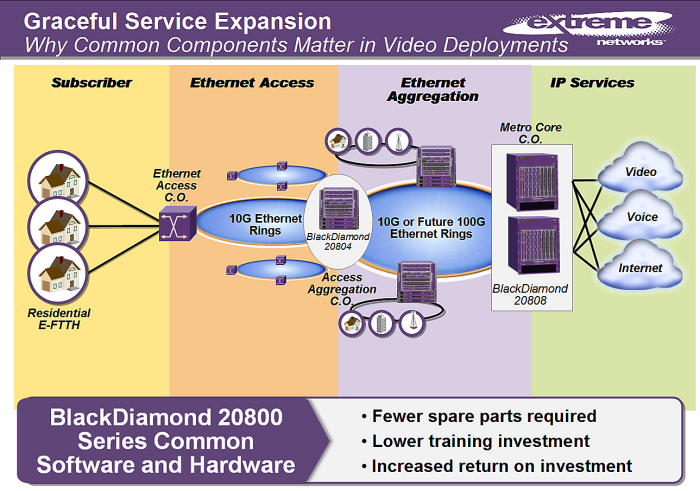

MS: Yes. Imagine that we’ve expanded the reference architecture I described previously and have visually split Ethernet access and aggregation into two layers [See illustration at right]. The BlackDiamond 20808 provides the metro core connectivity, and the BlackDiamond 20804 in the access aggregation layer provides for the distribution of 10 Gbps Ethernet rings.

MS: Yes. Imagine that we’ve expanded the reference architecture I described previously and have visually split Ethernet access and aggregation into two layers [See illustration at right]. The BlackDiamond 20808 provides the metro core connectivity, and the BlackDiamond 20804 in the access aggregation layer provides for the distribution of 10 Gbps Ethernet rings.

We can see here that common components matter. Because a carrier usually starts small, with the deployment of a video application in conjunction with a 20804, and then they want to expand.

They end up with an architecture that we see many of our large carriers use, where they have Ethernet aggregation rings that can grow to 100 Gigabits per second that distribute out to Ethernet access central offices on multiple 10 Gbps rings.

The common components reduce the total cost of ownership in a number of ways. Fewer spare parts are required, and there’s lower investment in training. Taken altogether, these things increase the return on investment for the carrier.

PL: One of the things that’s interesting to note is that we’ve had customers from carriers in the rural areas, and a smaller independent operating company might use the Ethernet access portion of this architecture with a BlackDiamond 20804, but it’s also nice for them to know that if they want to interconnect with other networks—if it’s a carrier that’s still growing—that they still have the opportunity to take that same architecture and scale that up to something like what we’ve deployed in Croatia, where the entire nation of Croatia runs on an Extreme Networks IPTV backbone.

So we provide a very scalable architecture. A carrier can start as a service provider that has just a few thousand residential subscribers and then they can scale that up to beyond 100,000 users.

MS: From a competitive viewpoint, one of the things that is convenient to point out here is that if a customer is looking at a Cisco solution, they really don’t have this ability to be able to position a product that is right-sized for each point in the network—that provides a commonality of hardware and software.

If you look at the 7600 from Cisco and ASR 9000 Series Aggregation Services Routers, they don’t reuse the same line cards. They have different variations of software. So if a carrier wants to scale a network they have to invest a lot more not only in the cost of the equipment but in the cost of the operational side.

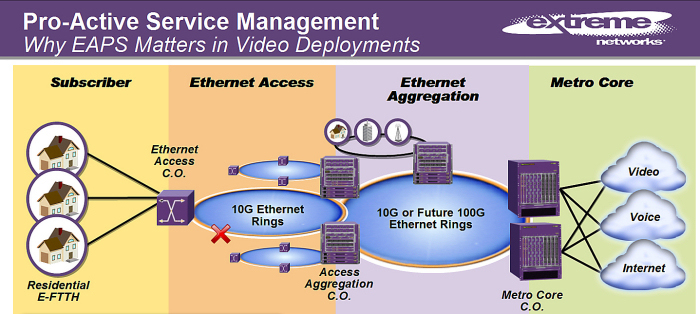

Now I want to talk about why EAPS [Ethernet Automatic Protection Switching] matters in video deployments. Remember that carriers using SONET since its appearance in 1984 have deployed fiber in the ground for many years in ring topologies. If carriers are going to reuse this ring topology in a next-generation world, then an Ethernet ring is a great way to do that. Ethernet rings allow carriers to re-use their investment in the fiber that you put into the ground and then EAPS becomes a standard method, just like we saw with APS and SONET, to be able to provide this ring resiliency. As it happens, Extreme Networks invented EAPS over seven years ago, published it as an RFC [Request for Comments], RFC 3619, to be exact. A number of companies since then have developed alternatives of that, such as Allied Telesis, Occam Networks, Calix, Juniper, and so forth. So a number of companies have Ethernet ring technolgoy and protocols that are variances of what we do. In the ITU, we’ve also seen a new standard appear, G.8032 which is a global standard for ring resilience. We at Extreme Networks is active on that standards body. We’re a member. We’re driving it forward, and we’ve been watching it closely. We’ve found that while there are a lot of great things in G.8032, it is still not as advanced as where we are with EAPS, based on our seven years of deployments with hundreds of customers and thousands of rings around the world.

Now I want to talk about why EAPS [Ethernet Automatic Protection Switching] matters in video deployments. Remember that carriers using SONET since its appearance in 1984 have deployed fiber in the ground for many years in ring topologies. If carriers are going to reuse this ring topology in a next-generation world, then an Ethernet ring is a great way to do that. Ethernet rings allow carriers to re-use their investment in the fiber that you put into the ground and then EAPS becomes a standard method, just like we saw with APS and SONET, to be able to provide this ring resiliency. As it happens, Extreme Networks invented EAPS over seven years ago, published it as an RFC [Request for Comments], RFC 3619, to be exact. A number of companies since then have developed alternatives of that, such as Allied Telesis, Occam Networks, Calix, Juniper, and so forth. So a number of companies have Ethernet ring technolgoy and protocols that are variances of what we do. In the ITU, we’ve also seen a new standard appear, G.8032 which is a global standard for ring resilience. We at Extreme Networks is active on that standards body. We’re a member. We’re driving it forward, and we’ve been watching it closely. We’ve found that while there are a lot of great things in G.8032, it is still not as advanced as where we are with EAPS, based on our seven years of deployments with hundreds of customers and thousands of rings around the world.

If you look at what carriers expected out of SONET and SDH, they built networks with subtended rings: There was an access SONET ring, an aggregation SONET ring and naked run protection across those rings. Carriers are looking for the same thing APS from Ethernet. So what EAPS does that G.8032 does not yet do is to provide this ability to support subtended rings with dual-node interconnect across these two domains. You might ask where does that matter. Well, at the point in the network where you find the access aggregation CO, there are often two switches deployed there for redundancy. Then you have to connect that access aggregation CO to multiple access rings that also need to interconnect with each other, and those access rings also need to connect to the aggregation ring. The ability to support subtended rings with a dual-node interconnect across access and aggregation area of the network is one of the key differentiators of EAPS against other protocols. It’s available across our entire product line, such as our 1R-high Summit boxes, and the BlackDiamond 20804 and 20808.

EAPS allows a carrier to provide proactive service management in that they can design a network that is resilient—if a problem occurs there’s automatic failover, protection of services and the subscriber won’t even know that anything unusual has occurred. EAPS also supports spatial reuse with multiple domains to improve efficiency and prioritize services.

What carriers are looking to do is to deploy a topology that provides protection and reuses their assets. Utilizing everything we learned in our experience with SONET really helps the carrier reuse their investment and their craft as well.

RG: I keep predicting the end of the fiber glut, but there still seems to be quite a bit of dark fiber capacity left, despite the increase in mobile users and bandwidth hungry applications such as video, and now mobile video, which will require huge backhaul in the form of both fiber and point-to-point microwave in the rural areas.

MS: I always laugh when people who aren’t in the industry ask me, “When is fiber going to go away? When is it all going to be wireless?” And of course I have to tell them that it takes fiber to connect the wireless tower to the rest of the network.

In any case, carriers need to have an easy-to-operate network. It’s all about cost of ownership. If you look at the competitive environment, the services are defined: There is IPTV, there’s residential triple-play, there’s business Ethernet, and then it’s about price/performance and how well your network works in terms of delivering on your investment. In 2008 we put together a model with Michael Kennedy at Network Strategy Partners. It essentially compares Extreme Networks’ Ethernet transport solution against a MPLS solution for a metro network. When looking at the five-year total cumulative CapEx and OpEx costs, Ethernet Transport is less than half of a Cisco MPLS [Multiprotocol Label Switching] based network. It is so much less expensive than MPLS not just because the Ethernet ports are less expensive than the MPLS ports, it also has to do with the fact that because we provide such high line rate port density in gigabits per second, we need fewer switches to carry the same amount of traffic. Because there are fewer switches, that lowers the cost of operations in a number of ways.

One of the biggest operational costs is the service maintenance contract. The annual service maintenance contract is a fixed percentage of your baseline CapEx, so if you have a lower-cost network with fewer switches, then on the capital side you’ll have a lower-cost operational expense in terms of an annual contract. Also, our BlackDiamond 20404 and 20808 occupy less rack space, require less power and thus produce less heat, so they need less ventilation and/or air conditioning. Moreover, the operational simplicity of Ethernet over MPLS provides an overall, lower-cost solution for carriers over the life of the network.

RG: MPLS proponents won’t like hearing that, since they tend to think that MPLS is the greatest thing since the proverbial sliced bread, since you can send circuit-switched stuff or whatever across it. But as for the economics of the situation, Ethernet always appears to be less expensive, which is why it survived against its competitors on the corporate LAN. I periodically joke about how I still have an old $700, 25-megabit per second ATM [Asynchronous Transport Mode] network card around here somewhere. We know what happened to ATM LANs when Fast Ethernet got going in the marketplace.

PL: As you say that, both Mark Showalter and I are nodding in agreement, since we both have some “ATM scar tissue” on our resumes. We both saw the light and moved over to the Ethernet path.

ML: What amazes me about Ethernet is how it has really evolved. It’s not exactly the same thing over time. It has somehow managed to add features as it goes along, to continue to be all it needs to be for the current situation. In the case of MPLS, we don’t see people widely deploying it in LAN in enterprises. Why? Because it’s expensive and complicated. We’re seeing the same thing here in the aggregation and access area of the networks. Carriers that have deployed MPLS in the core are trying to figure out how to roll it out to the edge, plus it’s very expensive. The people who are going to make money are going to be those who can keep the core intact, but lower the cost of connecting the core out to the subscriber, thus lower the cost of access.

RG: The economics of Ethernet once again means that it should win out in the long run, especially in today’s economy.

ML: Yes, the current downturn in the economy just makes a stronger case.

Highlights of the BlackDiamond 20804

ML: On the hardware side, the BlackDiamond 20804 has commonalities with its bigger brother.

ML: On the hardware side, the BlackDiamond 20804 has commonalities with its bigger brother.

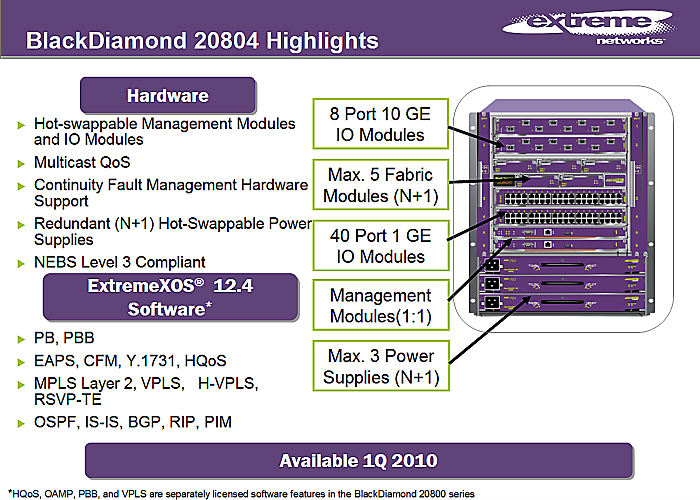

The 20804 has 8-port 10 Gigabit Ethernet I/O modules, supports a maximum of 5 fabric modules with redundant N+1 high availability. You can also load it with 40 ports of 1 Gigabit Ethernet I/O modules. Both the I/O modules and management modules are hot-swappable, and you can have a maximum of 3 power supplies onboard, also in an N+1 redundant arrangement. In fact, the whose system is NEBS Level 3 compliant. The system supports multicast QoS and our Extreme XOS software.

The BlackDiamond 20804 will be available in the first quarter of 2010.

In general the BlackDiamond 20800 Series has hardware and software commonalities between the switches that Cisco doesn’t have. You cannot reuse the same modules of, say the 7606 or 7609. As you know, the Cisco 7600 has been around for a long time. They originally had the 6500 Series and then they added more capabilities to it, but we really don’t see Cisco investing a lot more in terms of future capacity in the 7600. It caps at 40 Gbps of bandwidth per slot today. They haven’t yet announced a line rate 100 Gbps program for it, which means that, in terms of line rate and ports, it supports less than 4 line rate 10 Gigabit ports per slot. Compare that with our BlackDiamond 20804, which can support 8 line rate 10 Gbps Ethernet ports per slot.

The SR9000 is the next-generation platform for Cisco. It includes the ASR9006 and 9010. Some very cool marketing stuff has appeared on the ASR9000 Series. They talk about how the system supports 400 Gbps per slot, but that’s a future upgrade. They’ve announced a 16x10 Gbps line card board, but it isn’t line rate. Today, the switching fabric supports 40 Gbps per slot, so their 16-port card is very oversubscribed. To get access to higher line rate capability, you’re going to have to wait for Cisco to upgrade the hardware and fabric. It’s unlike our BlackDiamond 20800 Series today, which supports 120 Gbps per slot today. That gives you 8 full line rate 10 Gbps Ethernet ports per slot. You now have line rate 100 Gbps Ethernet capability in the form of a 100 Gig E module that just slides right in. We have hardware compatibility with our other equipment so the components are reusable across the 20804 and 20808. Furthermore, both the 20804 and the 20808 can be upgraded to 480 Gbps per slot with switch fabric upgrades, just like the way Cisco will eventually upgrade to 400 Gbps per slot.

The point of all this is that you get a lot more capability in our solid family of products that provide you with a low cost of ownership. You’re able to start small, grow large, reuse your investment and have line rate 10 Gig ports working high bandwidth services.

RG: The Brocade MLX 8 and 16 can do about 50 Gbps per slot, though I believe it will be line rate 100 Gbps ready only with a future upgrade.

MS: To sum up, the BlackDiamond 20804 is our fifth-generation of Ethernet transport solutions. It allows carriers to increase the longevity of their networks, by gracefully expanding video and other services. It allows carriers to ‘delight’ their subscribers by providing proactive service management instead of reactive circuit management. It lowers the cost of ownership in a number of ways, primarily by being easy to operate.

And remember, the BlackDiamond 20804 is part of the 20800 Series and it’s just is one of many products that Extreme Networks offers in the carrier Ethernet solution set.

RG: Okay guys, thanks for the great interview!

Back to Home Page Previous Columns Top of Page